Forecasting revenue and expenses for a new business is a difficult task. Expenses may be easy to track, but with less consistent revenue it can be tough to estimate how your business will do in the future. The problem is that tracking these numbers is a key part of launching a business, especially if you are planning to grow yours in the future.

Building accurate forecasts on an annual basis is essential to the order and running of your business, especially when you are just getting started. Predicting things like sales and incoming cash flow are never easy, and rough economic conditions like we’re experiencing at present can make business forecasting even more complex. Now, beyond just having to forecast how your business will perform, you also need to look at it through the lens of current affairs and take into account how that will affect what you are doing.

Keep reading for annual business forecast tips and business forecasting methods that can transform your business.

Planning Expenses

As a newer business, it’s easier to forecast expenses than it is to forecast revenue, which is why you should start by listing all of your business costs.

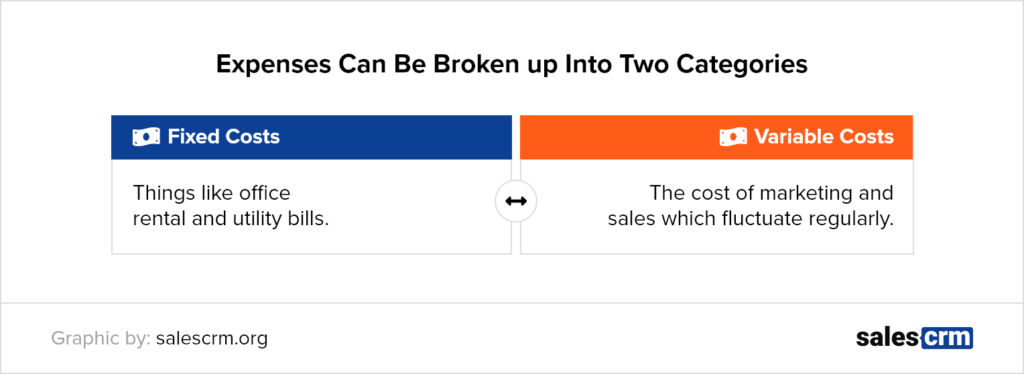

Expenses can be broken up into two categories – fixed costs and variable costs; fixed costs are things like office rental and utility bills, while variable costs are the cost of marketing and sales which fluctuate regularly. It’s recommended to double your estimates for variable costs like marketing, as their costs quickly escalate depending on how fast you scale your business.

The same applies to estimates for any legal, insurance, or other similar business expenses – these can be hard to predict from the offset when you are unsure of how to forecast expenses. Instead of underestimating, it is better to overestimate and be sure that you are not caught up in any nasty surprises later.

You also want to track customer service and sales, even if you are working with a smaller team. Forecasting this expense right now becomes important when you scale and will help you to better understand your cost of client acquisition.

Forecasting Revenues

Entrepreneurs should ideally create two sets of projections for revenue; one conservative, and one aggressive. Conservative revenue forecasts work on lower assumptions, such as having a low price point, only one or two marketing channels, and minimal sales staff. An aggressive forecast on the other hand follows assumptions like asking a premium price for services, having multiple marketing channels, and a bigger team. While aggressive forecasts are less likely to come to fruition, it does help the entrepreneur to dream big and set goals for the business that they would like to achieve and gives them something to work towards. A conservative revenue forecast, on the other hand, will let you know what your minimums are and highlight ways to increase capacity.

When you are reconciling your revenue and expense forecasts, make use of ratios to clarify more precise data. These ratios include calculating your gross margin, your operating profit margin, or your cost per acquired client. The reason that this is done annually is so you can measure your growth on a yearly basis and track your progression.

Sales Assumptions

Year-on-year circumstances for your business will vary, which makes it important to forecast your sales assumptions through the lens of recent events. Typical sales assumptions could be, for example, that your market may grow or decline by 2% depending on your success and market demand that year. In years like this one, you should conduct additional market research to get a clearer idea of what declines there are to expect. Many industries have experienced a significant fluctuation in 2020 due to global shutdowns which have affected market confidence.

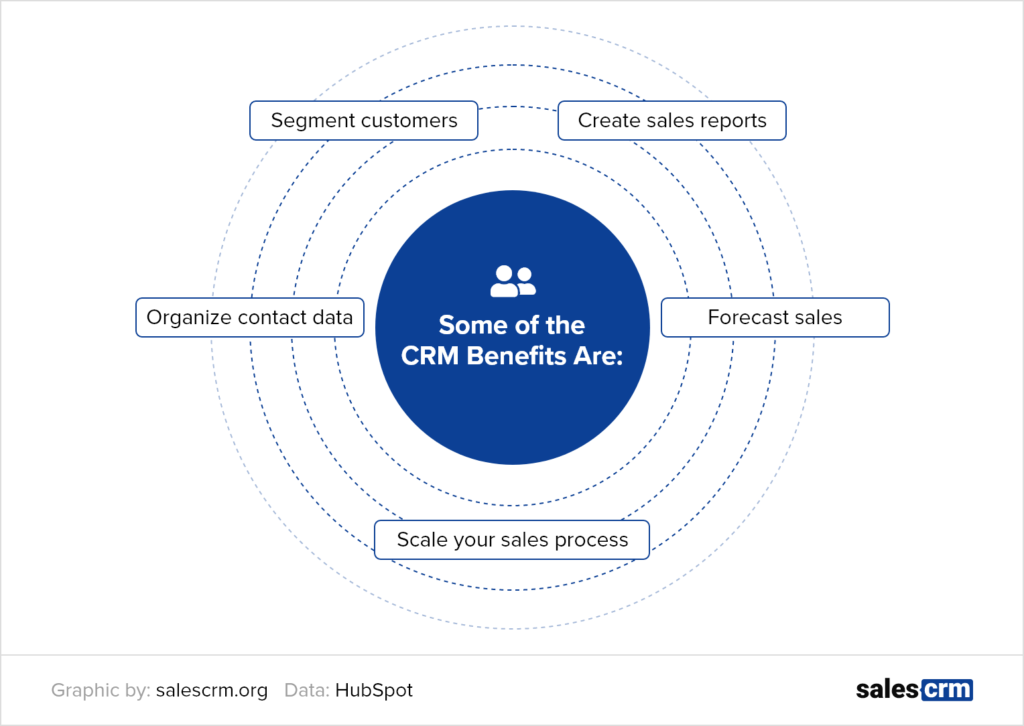

It is worth noting that conversion rates are usually higher when selling to existing customers – you should keep this in mind when making sales assumptions in forecasting. By trying to predict sales on an ongoing basis it’s possible to get a more accurate forecast. There is also a variety of software on the market that can assist you with these forecasts and more, such as SalesCRM. SalesCRM is a straightforward CRM for service businesses that helps with prospect management, handling multiple stakeholders, and much, much more.

Benefits of CRMs

There are multiple benefits to implementing a CRM like SalesCRM early in your business process. Research conducted by Hubspot found that the majority of sales managers using a CRM found it helped increase sales over the long-term. The power for forecasting using a CRM is access to data; leads, conversions, and other information to use in your predictions. Think of a CRM as an all-in-one solution for projections, customer management, and other business tasks that usually involve a lot of time and effort on the part of the entrepreneur.

CRMs with sales forecasting abilities can help entrepreneurs get a better idea of future sales based on the deals that are currently in their pipeline. Many CRM options have the option to generate sales forecasts on demand, making the predictions process much simpler for entrepreneurs. CRMs also improves organization, brings the advantage of task automation, and makes delivering good customer service much simpler as a result.

Final Thoughts

Creating an accurate forecast for your business is an essential part of understanding your expenses, revenue, and more important information that will become increasingly pertinent as you scale your business. Ensuring that forecast is accurate can be easier said than done. Using a CRM can assist in generating regular sales forecasts and provide other key benefits that can help grow your business from strength to strength.

From there, it is up to the entrepreneur to manage the budget vs forecast. While projecting for the future of your business can be tough, this is a step that should not be overlooked, especially in times of economic turmoil.